Table of Content

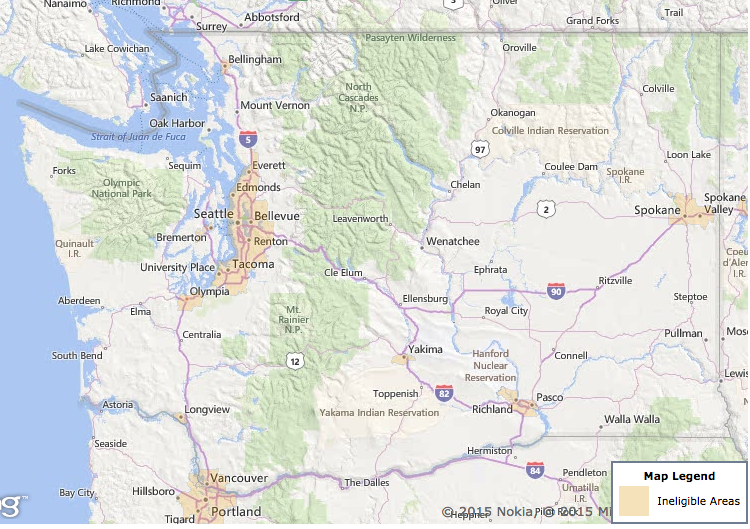

USDA’s website has a search option that will determine a specific address or region’s eligibility. Particular areas of the U.S. can be searched and viewed and the map indicates whether or not the subject area is geographically valid. On the interactive USDA rural eligibility map, users can zoom in and out to view various parts of the nation. The map can zoom in enough to reveal specific addresses, but if the user is trying to establish which areas are USDA-approved, the map search can be limited to neighborhoods or cities.

Buyers in large cities and more densely populated suburbs aren’t eligible for these loans, but many living in surrounding towns and cities may be. An area with a population of 35,000 or less can be considered “rural” in the USDA’s eyes. Some products and services may not be available in all states. Programs, rates, terms and conditions are subject to change without notice. Processing times vary depending on funding availability and program demand in the area in which an applicant is interested in buying and completeness of the application package.

Cuttler Rd New Caney Texas 77357

Unfortunately, when you get a USDA loan, you must pay mortgage insurance for the entirety of the loan. Again, this enables you to buy a house without having any savings on hand. You can just add the extra $3,000 to $6,000 in closing costs onto your loan and pay it off over time or ask the seller to contribute up to 6% seller concessions. These datasets are referenced in the scoring of applications requesting grant funds as part of the funding type request.

We offer loan guarantees to help eligible businesses and manufacturers expand or improve, and we support energy programs that finance renewable systems for agriculture and industry. Because so many of our employees live and work in the very communities we serve, the USDA Rural Development mission is personal to us. It’s this commitment to our neighbors that sets us apart. More than a great place to live, it’s the people who make up America’s spirit and character.

Allow for Low Credit Scores

Seller concessions may include all or part of a purchase’s state and local government fees, lender costs, title charges, and any number of home and pest inspections. USDA loan rates are often lower than conventional 30-year fixed mortgage rates. This means a USDA loan is often more affordable overall than a comparable FHA or conventional loan. Many USDA-approved lenders don’t even list the USDA loan on their loan application menu. So if you think you’re eligible for a zero-down USDA loan, it’s worth asking your shortlist of lenders whether they offer this program.

The income limits relate to the area’s median household income and may not exceed 115% of this number. This is determined by your adjusted annual income by calculating deductions from your regular annual income. Resident, qualified alien, or non-citizen national seeking a mortgage for a home in a neighborhood or area zoned rural. You can only purchase the home as a primary residence and certain income limits apply. Most people have never even heard of a USDA loan let alone understand the USDA loan requirements to obtain a mortgage.

Type of Property You Want

USDA has posted its proposed rules, revised rules and final regulations related to the development of rural areas. Customers may submit an electronic comment for any rule currently open for comment. Veterans and active US military may be eligible for a $0 down VA loan. In terms of property values, the home cannot be more than the value of the loan amount. When it comes to homes, the property must be 2,000 sq.

The evaluation criteria datasets defined below will remain unchanged for the duration of the Fiscal Year 2022 application window. To learn more about USDA home loan programs and how to apply for a USDA loan, click on one of the USDA Loan program links above and then select the Loan Program Basics link for the selected program. USDA eligible homes open the door to countless benefits. For one, USDA loans require no down payment, which can make purchasing a home significantly more affordable upfront.

However, for a USDA loan it’s only .35% of your loan amount. For reference on what areas are eligible for a USDA loan,consult this tool. So, if you want to buy a fixer-upper, you can bring it back to life with the help of a USDA loan with up to 10k in repairs. Located in the enchantingly peaceful De Leon Springs, this forty-three-acre home is truly one of a kind.

ICB Solutions and Mortgage Research Center receive compensation for providing marketing services to a select group of companies involved in helping consumers find, buy or refinance homes. If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request. By submitting your information you agree Mortgage Research Center can provide your information to one of these companies, who will then contact you. Neither Mortgage Research Center nor ICB Solutions guarantees that you will be eligible for a loan through the USDA loan program. USDALoans.com will not charge, seek or accept fees of any kind from you. Mortgage products are not offered directly on the USDALoans.com website and if you are connected to a lender through USDALoans.com, specific terms and conditions from that lender will apply.

Finally, USDA loans also have lax credit standards compared to many mortgage loan options. That can make it easier to qualify for the loan in the first place. Providing these affordable homeownership opportunities promotes prosperity, which in turn creates thriving communities and improves the quality of life in rural areas. Effective December 1, 2022, the current interest rate for Single Family Housing Direct home loans is 3.75% for low-income and very low-income borrowers. USDA loan requirements are not as stiff or stringent as you might think. The stipulations are merely in place to ensure that only those that qualify may obtain a mortgage through this type of program.

If you have less than two years in a job, however, you may not be able to use your bonus income for qualification purposes. The USDA Rural Housing loan is available as a 30-year fixed-rate mortgage only. There is no 15-year fixed option, or adjustable-rate mortgage program available via the USDA. The U.S. Department of Agriculture’s website maintains a list of approved lenders for the Rural Housing Program.

The USDA wants to ensure that the home you choose meets certain property requirements to protect the borrower's interest and well-being. The good news is that most of the country is in what the USDA considers a qualified rural area. But it's important for prospective buyers to check a home's eligibility status before getting too far into the process. Moreover, the state won’t consider any income from anyone who doesn’t live in the house officially, such as a live-in nurse.

Instead, the government will guarantee the loan to the lender. As a result, the lender will feel more comfortable approving an applicant backed by the USDA. Yes, a borrower’s household income cannot exceed 115 percent of the area’s median income. Yes, the USDA loan program can be used to purchase and install materials meant to improve a home’s energy efficiency, including windows, roofing, and solar panels.

USDA Home & Property Search – USDA Homes

Perhaps you need money to fix up the place once you have it. There are lots ofsurprises when it comes to the USDA loan. One of them is the income requirement that comes with the loan.

No comments:

Post a Comment